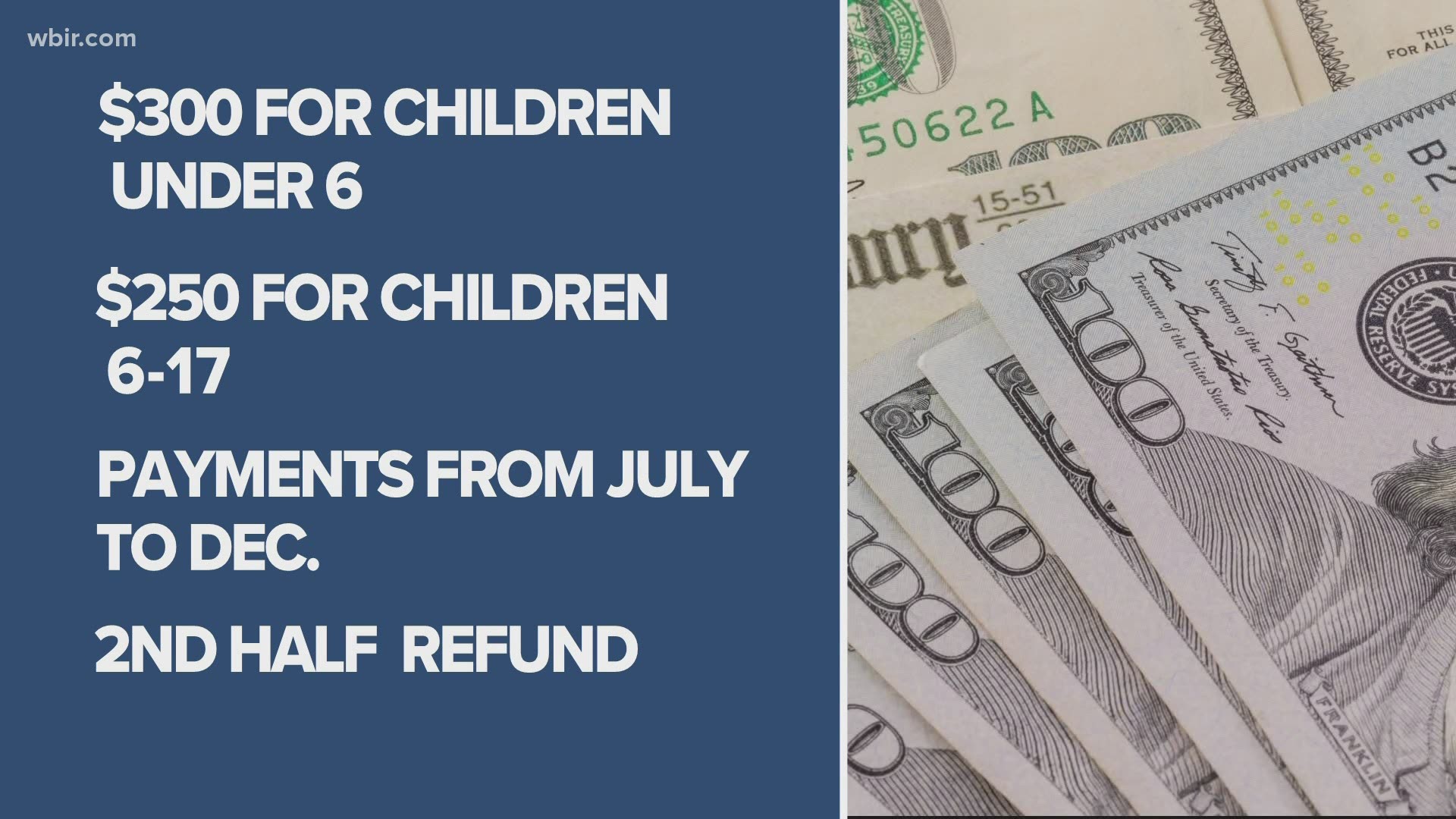

child tax credit payment schedule and amount

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Monday Is Last Day To Sign Up For Child Tax Credit If You Have Not Received Payments In The Last Six Months

Families could be eligible to.

. To reconcile those amounts with. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. Monthly deposits of the Child Tax Credit started on July 15.

The first of six monthly payments through the enhanced Child Tax Credit arrived on July 15 with most parents of children who are 17 or younger getting one of the deposits. While the General Assembly. So if you have a child between 6 and 17 you will get 250 every month between July and December 2021.

There are seven federal income tax rates in 2023. All payment dates. For more information about the Credit for Other Dependents see the Instructions for Schedule 8812 Form 1040.

Foster care payment schedule 2021. The next payment is due on August 13. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

This fact sheet talks about the different ways you can get a child tax credit even if you are not the childs biological parent. In May The Federal Reserve released a survey claiming Parents who received monthly child tax credit payments most. Havent received your payment.

The Federal Reserve published a survey on CTC. If you do not qualify to receive the maximum amount. Have been a US.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both. Wait 5 working days from the payment date to contact.

As part of the American Rescue Act signed into law by President Joe Biden in March of. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Each subsequent payment will be issued on the 15th of the month through.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The amount of credit you receive is based on. Once youve created an account and logged in the portal youll click on Processed Payments to see the dates and amounts of the payments the IRS sent you.

Determine if you are eligible and how to get paid. The balance of 1500 will be part of your tax return in 2022. Advance Child Tax Credit.

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit You Can Opt Out Of Monthly Payment Soon King5 Com

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Child Tax Credit Wondering About Your January Monthly Payment Silive Com

Maria Cervantes Mc S Tax Financial Group You Are Not Required To Receive Monthly Child Tax Credit Payments This Year Instead You Can Choose To Get A Payment In 2022 And The New

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Another Child Tax Credit Payment Is Being Sent Today

Child Tax Credit 2021 What To Know About New Advance Payments

Child Tax Credit Payments Are Being Sent Today

Child Tax Credit Dates Here S The Entire 2021 Schedule Money